Invest in Gold or Hold Dollars? The Simplest Explanation

Ever wondered whether to hold US dollars or invest in gold? This video makes the comparison easy and straightforward. I break down the pros and cons of holding USD versus buying and holding gold, considering various factors like saving with compound interest and taxes over time. Our simple explanations and clear comparisons help you understand which option might be best for your financial goals. Whether you’re a seasoned investor or new to the world of finance, this video is a must-watch for anyone looking to make informed decisions about their assets.

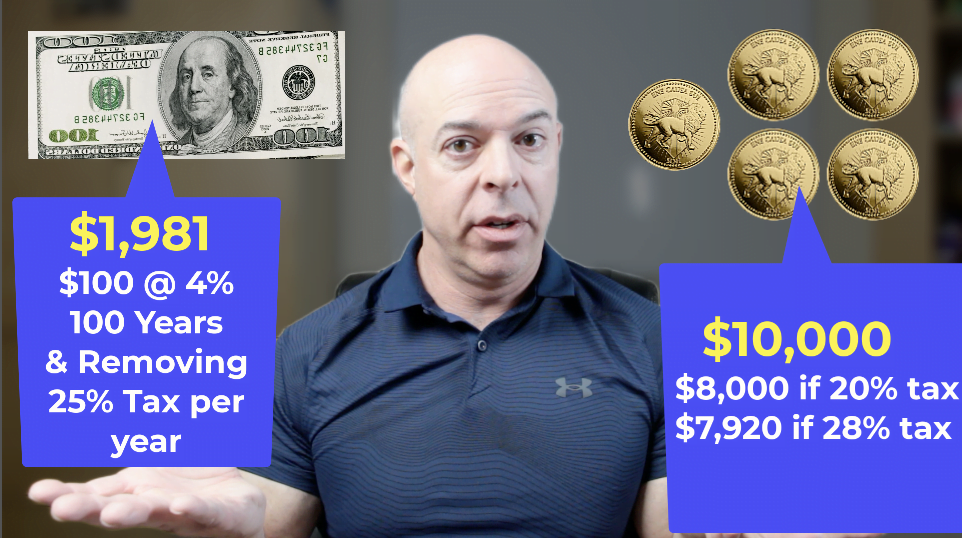

Historical Comparison: 100 years ago, $100 could buy 5 ounces of gold at $20 per ounce. Today, those 5 ounces are worth $10,000 while the $100 remains $100.

Investment Growth: If $100 was invested at an average interest rate of 4% over 100 years, it would grow to $5,424. However, after accounting for taxes, it would be about $1,981.

Tax Implications: Gold appreciates without generating taxable income, so no taxes are paid until it is sold. On the other hand, interest from savings is taxed yearly.

Inheritance Advantage: Inherited gold is valued at its fair market value at the time of inheritance, which can significantly reduce the tax burden compared to other investments.

Diversification Advice: The speaker emphasizes the importance of diversifying investments across various assets, including gold, silver, crypto, bonds, and stocks.

Want to automate your gold and silver investments then learn how by watching the video.